Luxfunds Portfolio Strategic Allocation

Luxfunds Portfolio Strategic Allocation has been designed to meet the needs of investors seeking stability and performance, even under the most uncertain market conditions.

Marketing communication intended for retail investors in Luxembourg. Please refer to the Prospectus of the UCITS and the Key Information Document (KID) before making any final investment decision.

Unrivalled flexibility for your peace of mind

Luxfunds Portfolio Strategic Allocation offers innovative, flexible, diversified management that complements traditional management strategies. Our investment process is based on an approach of ongoing evolution to offer you a multi-strategy and multi-thematic solution at any time, adapted to the current market environment (such as the recent resurgence of inflation).

Our approach is based on:

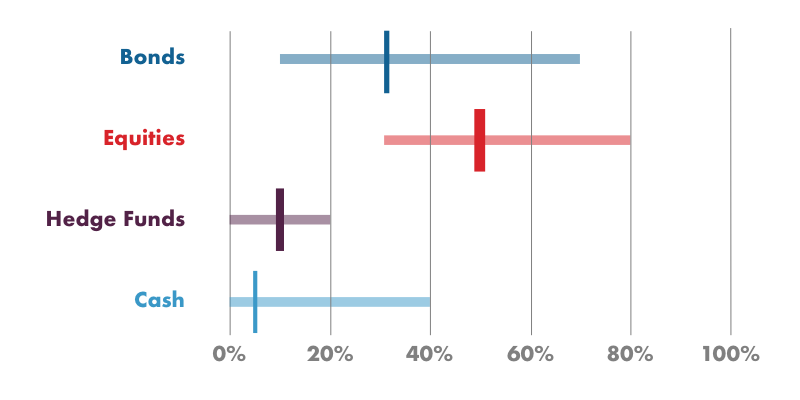

- Long-term strategic management: Carefully balanced exposures to equities, bonds, hedge funds and currencies, tailored to each investor’s risk profile.

- A medium-term cyclical allocation: Proactive adjustment of the portfolio according to market cycles, in order to capture opportunities and minimise risks.

- Short-term tactical adjustments: Tools such as duration management or liquid derivatives help absorb market shocks and preserve the value of the portfolio.

Global expertise, local trust

Spuerkeess & Edmond de Rothschild

To strengthen our commitment, Spuerkeess Asset Management has worked in collaboration with Edmond de Rothschild Asset Management, a world-renowned leader in asset management, to bring their exclusive expertise to bear on a unique fund in our range.

This fund stands out for its flexible investment strategy, drawing on the unrivalled expertise of Edmond de Rothschild Asset Management to adapt to market changes in a dynamic manner.

This collaboration combines Spuerkeess Asset Management’s solid management framework with the specialised knowledge of Edmond de Rothschild Asset Management, creating a unique investment opportunity for those seeking a diversified global allocation with a focus on agility and performance.